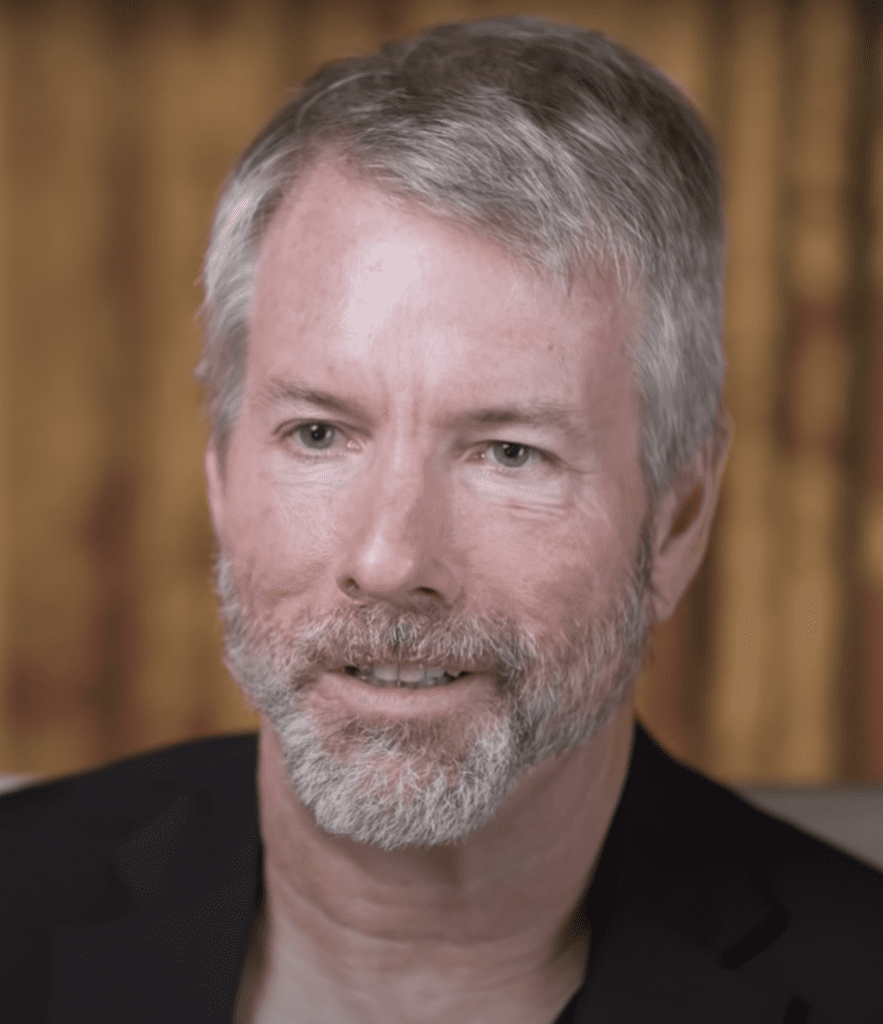

Bitcoin Billionaire Michael Saylor, MicroStrategy to Pay D.C. $40 Million

By • June 3, 2024 0 2445

“Michael J. Saylor and MicroStrategy, Inc., the company he co-founded and led, will pay $40 million to resolve a tax fraud lawsuit filed by the Office of the Attorney General (OAG) alleging that Saylor had defrauded the District of over $25 million in income taxes,” District of Columbia Attorney General Brian L. Schwalb announced June 3.

The settlement is the largest income tax fraud recovery in D.C. history. By agreeing to the settlement, Saylor and MicroStrategy admit no liability or wrongdoing.

OAG’s lawsuit—the first of its kind brought under updates to the D.C. False Claims Act—detailed “how Saylor, despite living in the District, illegally pretended to live in lower-tax jurisdictions in an attempt to avoid paying taxes on hundreds of millions of dollars of income. Saylor called the District home since at least 2005, renovating and living in a 7,000-square foot Georgetown penthouse and docking multiple yachts at Washington Harbour. Under the settlement, Saylor and MicroStrategy must pay $40 million to resolve the District’s lawsuit.”

Schwalb added: “Tax cheats are freeloading off the backs of hardworking, law-abiding, tax paying District residents while depriving our city of resources needed for critical programs, including public safety, infrastructure and education. Michael Saylor and his company, MicroStrategy, defrauded the District and all of its residents for years. Indeed, Saylor openly bragged about his tax-evasion scheme, encouraging his friends to follow his example and contending that anyone who paid taxes to the District was stupid. This precedent-setting settlement makes clear that no one in the District of Columbia, no matter how wealthy or powerful they may be, is above the law.”

Background on Lawsuit Against Saylor, According to the OAG

In 2021, whistleblowers filed a lawsuit against Michael J. Saylor alleging that he had defrauded the District and failed to pay income taxes he legally owed from 2014 through 2020. The whistleblowers’ complaint also alleged that Saylor openly bragged to friends and acquaintances about evading D.C. taxes, encouraging them to follow his example.

After independently investigating the tax fraud allegations against Saylor, OAG intervened in the whistleblower lawsuit and filed its own complaint against Saylor. The District’s lawsuit alleged that Saylor lived in the District but pretended to be a resident of Florida (a state with no personal income tax) or Virginia (a state with lower income tax) to avoid paying more than $25 million in District income taxes. In addition to the 2014-2020 tax years addressed by the whistleblowers’ complaint, the District also sought to recover taxes that Saylor failed to pay for the tax years 2005 through 2013.

As part of his fraudulent tax avoidance scheme, Saylor enlisted the assistance of his company, MicroStrategy, a technology corporation he founded and led. MicroStrategy employees falsely reported address information on the W-2s the company issued to Saylor and also omitted Saylor’s accurate information from the withholding filings it submitted to the District. Saylor and MicroStrategy knew that these records and statements were false, especially because MicroStrategy employees maintained detailed logs of Saylor’s precise whereabouts throughout much of this period. With its suit, the District sought to collect back taxes, as well as interest and penalties.

Under the terms of the settlement, Saylor and MicroStrategy will pay $40 million to the District, the largest income tax recovery in District history.

A copy of the District’s amended complaint is available here.

A copy of the settlement is available here.

This matter was handled by Assistant Attorneys General Norman Anderson, Jason Jones, Sarah Levine, Jessica Micciolo and Charlie Sinks, Senior Trial Counsel Laura Beckerman and Workers’ Rights and Antifraud Section Chief Graham Lake.

Read two of The Georgetowner’s previous articles about Saylor here (2022) and here (2012).