News & Politics

Election Preparedness in Georgetown and the Rest of D.C.

Arts & Society

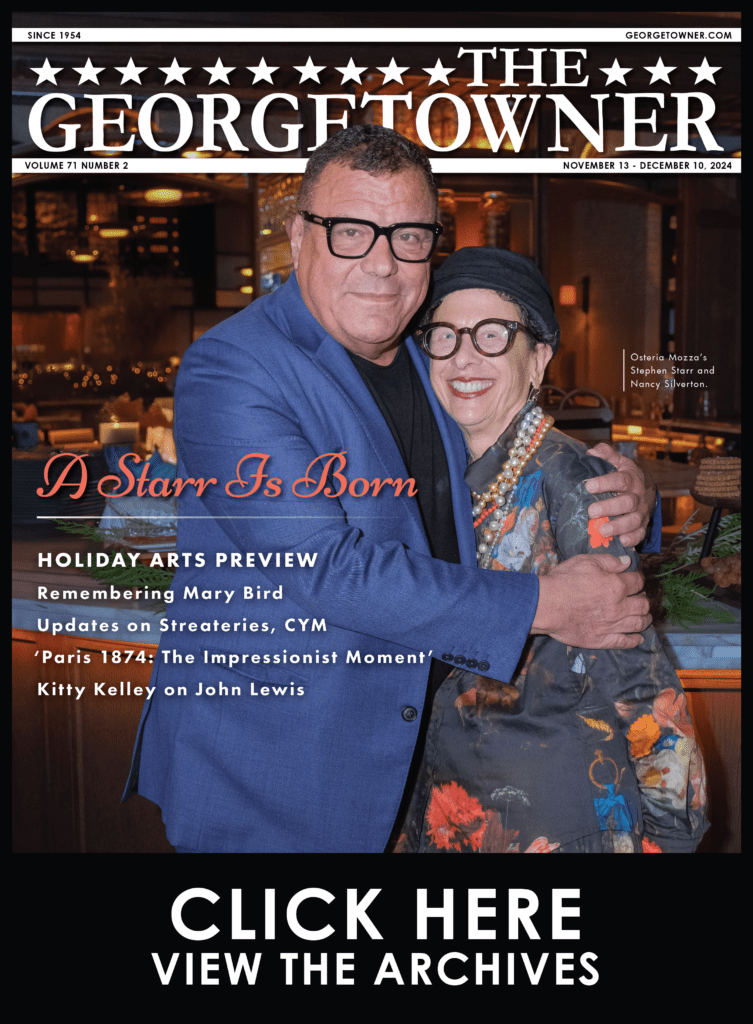

Osteria Mozza, Georgetown’s New Culinary Star

Featured

Business Ins & Outs: Osteria Mozza, Barnes & Noble, Framebridge

Featured

Business Ins & Outs: Billy Hicks, Marine Layer, Sweaty Betty

News & Politics

Catching Up With Ward 2 Council Member Brooke Pinto

IPhone 6: Worth the Hype

• October 1, 2014

The most readily-apparent differences between the iPhone 6 and its predecessor are in form: where the iPhone 5 is a little boxy, the iPhone 6 is slim and trim, striking an impressive balance between substantiality and lightness of being. Though 17 grams heavier than its predecessor, the phone’s weight increase is balanced in such a way that the feel of the iPhone 6 is more reassuring than that of the iPhone 5.

The 4.7-inch display on the iPhone 6 (up from 4 inches on the iPhone 5), is just enough of an increase to deliver much-needed real estate without inflating the iPhone 6 to a degree that would require extra space to carry or a closer eye to look at the screen. In terms of display quality, though, the odd choice of a 1334 x 750 resolution for the iPhone 6 doesn’t change the pixel density one bit; the iPhone 5, 5c and 5s all sport the iPhone 6’s 326ppi.

In terms of functionality, the iPhone 6 offers little in the way of earth-shattering improvements. Looking past the changes in iOS 8, the hardware upgrades seem to have a negligible impact on performance, despite the inclusion of the much-touted Apple A8 processor, which replaces the A7 in the iPhone 5s. Apple claims the A8 is 25 percent faster and has 50 percent better graphics than the A7, though the average user likely won’t notice a huge difference with today’s mainstream apps.

With the iPhone 6, Apple has stuck by the 1GB RAM allotment of the iPhone 5 in a nod to prolonging battery life. However, RAM bottlenecks tend to account for more performance degradations in the end-user experience than underpowered processors.

And what about battery life? According to Apple’s estimates, there is a significant improvement in the audio category; you’ll get an additional 10 hours of music time out of the iPhone 6, up to 50 total hours, compared to the 40 hours estimated for the iPhone 5s. Across the other categories – video, Wi-Fi, LTE and 3G browsing – the increases are token and insubstantial

The majority of the bells-and-whistles associated with the iPhone 6 come via iOS 8 and are as-yet-unrealized in their full potential. Apple Pay, the new near-field communications (NFC) technology incorporated into the iPhone 6 that will theoretically allow iPhone 6 owners to use their devices as a tap-and-go credit card, is still in its infancy. Metal, Apple’s new technology geared towards mobile game developers, will supposedly allow the creation of more immersive and richly detailed games that take advantage of the iPhone 6’s new hardware. Apps that leverage Metal will take time to become available, though.

The Takeaway: Wait and see. The iPhone 6 and iOS 8 have real potential, both individually and as a team. But unless you dislike the iPhone 5 for aesthetic reasons or are one of those who simply must have the latest and greatest on day one, my advice would be to wait a few months to let Apple work out the unavoidable new-release kinks and give the wider tech world a chance to capitalize on the new development features.

Bluemercury Rising

• September 26, 2014

Marla Beck, wearing a sleeveless black dress and gold cuff bracelet, and Barry Beck, in a crisp white shirt and silvery blue tie, appear as one might imagine the founders of a $100-million luxury cosmetics and skincare company to be: chic, well-groomed and smelling slightly of Barry’s favorite body wash, Molton Brown Black Peppercorn.

Yet the couple, who’ve gone from owning one Bluemercury store at 3059 M St., NW, 15 years ago to 55 nationwide today, revolutionizing the beauty business in the process, would prefer customers to think of them simply as the “mom and pop” of the industry.

“It used to bug us a little when people would say, ‘Oh, those Bluemercury beauty shops.’ We wanted to be this big national chain. The truth is that today, it’s this mom-and-pop shop feeling that’s really been the driver of our success,” said Barry, sitting with Marla in their Georgetown headquarters.

Success in this case means owning the fastest growing beauty and spa business in the country, with 20 to 30 stores opening in the next year, plus an Internet business that earns the equivalent of 60 brick and mortar stores. Indeed, in the District, home to four stores including the Georgetown original, Ward 2 Councilman Jack Evans declared Sept. 13, “Bluemercury Day,” after the District Council voted unanimously in favor of the designation.

The concept of the beauty shop around the corner began with Marla, a California native and self-professed “product junkie” who was getting facials before most people had heard of them. After graduating from the University of California at Berkeley, she attended Harvard Business School in Boston, where she would drive 45 minutes to buy her favorite MAC lipstick because cosmetics were sold only in drug and department stores.

“In the back of my mind, I always loved the business,” she recalled, flashing a smile. “But it wasn’t something I was focused on until I came here to D.C.”

She moved to Washington to head up mergers and acquisitions for a large janitorial services company but was more interested in running her own business. She’d heard Jeff Bezos give a speech in 1997 about the future of e-commerce and “caught the bug.” She knew there was a gap in the cosmetics market and was mulling the idea of bringing luxury cosmetics to the Internet.

It was right around this time that she met Barry, who owned a maintenance company he had started with his brother while at Cornell University. He was trying to sell that company to the company Marla worked for.

“I’m embarrassed to say I never even looked at Marla the whole time during the meeting,” Barry recalled, relishing telling the story. “Honestly, I thought she was the secretary. She never said a word. She was just watching me the whole time. At the end of the meeting, she said, ‘By the way, I’m the head of M&A. I make all the decisions about which companies we buy and which ones we don’t.’”

Afterward, his brother asked him how the meeting went. Barry replied: “I don’t know, but I think I’m resigning. I think I met the woman I’m going to marry.”

She didn’t buy his company, but Barry did ask her out. In fact, the two left their jobs and raised $1 million in investment capital to create Bluemercury online and open one brick-and-mortar store in 1999.

They also started a life together in Georgetown, getting married (at store number four), having three children (stores five, eight, and thirteen) and finally, today, employing 600-plus people.

Like any good partnership – personal or public – the Becks appear to fill in each other’s gaps. In business, she is the CEO, a strategist who handles all things customer-related: merchandising, marketing, staffing and product development. He is the COO, the tactician who oversees finance, real estate and e-commerce.

He is also the boyish talker who clearly loves to tell – and sell – their story, while she’s the quiet listener who occasionally interjects with a clarification or correction.

At one point Barry said that Bluemercury has more stores than Neiman Marcus and Saks combined.

“I don’t think that’s true,” Marla said quickly. “We should count them.”

“Well, yes, we should count them,” Barry agreed “But it’s close.”

At another point, he revealed that next year the company is launching several new brands, including color cosmetics, haircare and sun-care lines, to which Marla said, “Wait, we’re not supposed to be talking about that.”

“We can’t tell you the names and what’s going to be in them,” Barry said. “We can’t tell you what they are. [But] we’re going to build a house of brands.”

Marla remained unfazed, leaving the salesmanship to him. But as soon as the conversation turned to her role in the business, her blue eyes lit up and her speech quickened. She takes a hands-on approach to hiring people and selecting products, she said, personally interviewing every store manager and trying every product that goes on the shelf.

In addition to selling dozens of brands such as Laura Mercier, Trish McEvoy and Bobbi Brown at Bluemercury stores, Marla launched her own line of natural, dermatologically-tested products called M-61 two years ago after seeing a gap in the market.

“A product has to have great quality, great packaging and a great plan for product development,” she explained. “I look for a lot of authenticity. That’s why we have makeup artists’ brands, because there are people behind them creating the product. I don’t like the fads where someone’s like, ‘I think this is cool this year.’ ”

Her perennial favorites are Trish McEvoy’s High-Volume Mascara and the M-61 Power Glow Peel. Here is the latter’s Bluemercury website description: “Marla loves this pre-makeup and pre-moisturizer before a very important event for a radiant glow. She also loves it for hormone-related breakouts, which she seems to get.”

Clearly, Marla, who pens a beauty blog, spends a good deal of time testing these products. Where does all this experimentation take place? They receive so many prospective products at their office, Barry said, that they put them in a spot dubbed “the garage.” Every so often, they pull them out, set them up and Marla goes through them like movie scripts with Post-it notes in hand.

“I’m like: ‘No, no, no, we need more information on this,’ or ‘Who’s doing this?’ or ‘This one I want to take home’,” she said.

“You know a brand is on its way into the store… ” Barry started. “Could be going in,” Marla interrupted.

Barry flashed his brown eyes at her, finishing, “Because the train stop right before that is in our bathroom.”

She did not disagree. In fact, there seems to be little the Becks don’t ultimately agree on, at least in business. Barry describes their partnership as “magical” and “this amazing combination that has really worked well for us.” Their list of professional accomplishments is long, including Marla’s recent appointment as Entrepreneur-in-Residence at Harvard Business School and Barry’s lecturing on entrepreneurship at Cornell and Columbia universities.

They seem to have figured out what works well for them at home, too. They include their three children, ages 7, 9 and 11, in store openings and activities as much as possible. “We’ve never seen our life as, ‘Here is our work life and here is our family life,’ ” Barry said. “It’s a blend. Bluemercury is who we are, who our family is.”

That life includes a considerable amount of business travel. Marla noted that she logged 13,000 miles in June alone and met with every store manager during August. “There was one week I was in a different city every day,” she said. “So it depends. But it’s a minimum of one day a week.”

Even so, they make a big effort to be home at night with their kids. If they need to visit a store together, no matter where it is, they try to make it a day trip. If going to the West Coast, they often fly out in the morning and take the red eye back.

“We like to go to bed under our own roof,” Barry said. “Husband, wife, three kids. The truth is, it’s a labor of love for us. We love what we’re doing. We’re excited to see a store in Santa Monica and can’t wait to get out there. And we also can’t wait to get back to our family.”

Another way they stay connected is by taking nightly walks through their Bethesda neighborhood, or wherever they happen to be. It’s a habit they started when they lived in Georgetown and would walk down to the monuments a few times a week. They’ve calculated they’ve walked halfway around the world.

“Last night, we walked almost five miles,” Barry said. “We were in a great conversation, saw something funny, gave each other a little hug…”

“And I walked into a tree,” said Marla with a laugh.

And if she got a scratch from the branch, she knew she could walk to the beauty shop down the street for the perfect product to cover it up. [gallery ids="101863,137669,137666,137660" nav="thumbs"]

Business Ins & Outs

• September 25, 2014

IN: George Becomes Chines Disco

Within Georgetown Court on Prospect Street, the restaurant/bar George rebooted itself as the Chinese Disco — a legendary name from a nightclub near 21st Street and Pennsylvania Avenue, NW, in the 1980s. Gone is the dark, black decor, replaced by a lighter, airier look. It still boasts a list-heavy, young crowd

OUT: Georgetown Theater to Be Rebuilt

Demolition and rehab work has begun on the old Georgetown Theater property along with its iconic “Georgetown” neon vertical sign. The sign was removed Sept. 16. by its original manufacturer, Jack Stone Signs, which still has all of the templates and parts. Property owner and architect Robert Bell told the Georgetowner about the upcoming reconstruction on the building at 1351 Wisconsin Ave., NW. He expects the sign to be returned in October, “during which time I will be removing the faux stone and stuccoing on the front façade to return it to the 1940 design.”

IN: Prospect Place to Replace Doggett’s Parking Lot

To the surprise of few in Georgetown, a new retail complex will replace the existing Doggett’s Parking Lot at 3220 Prospect St., NW. A redevelopment of the site, owned by the Weaver family for more than 100 years, was discussed before.

The 27,000-square-foot retail space will be called Prospect Place. It is across the street from the mixed-use Georgetown Court, which includes condos as well as Cafe Milano and Peacock Cafe.

A longtime Georgetown and Washington family, the Weavers own W.T. Weaver and Sons, a decorative plumbing and architectural hardware store. The family also owns the building adjacent to the parking lot property. The new Prospect Place will have underground parking, adding about 20 spots to the 80 which are now in use at the lot.

Planners will make a presentation about the site at the Sept. 29 meeting of the Georgetown-Burleith Advisory Neighborhood Commission; the Old Georgetown Board will meet Oct. 2. Work is expected to begin late next year.

IN: Via Umbria Pops in Former Tari Space

Authentic culture and cuisine from the Umbria region of Italy is coming to Georgetown in the form of Via Umbria, which moved into the old Tari space. Via Umbria will open its doors Sept. 27 as a pop-up shop with the full store and gallery to come next spring.

Located at 1525 Wisconsin Ave., NW, Via Umbria will feature four main businesses: the emporio (the shop), vino (wine), casa (the rental villa in Umbria) and galleria on the second floor (events and gallery space).

Owners Bill and Suzy Menard spent a semester in Umbria when they were students and fell in love with the region. Inspired by their trips to Italy, the couple opened Bella Italia, a shop in Bethesda offering authentic Italian products. The Menards decided to relocate to Georgetown with a new name to develop their concept even further. “The purchase has been months – nearly a year – in the making,” they wrote on their blog.

Four Seasons Celebrates 35 Years

•

There’s proof that the Golden Rule — “Do unto others as you would have them do unto you” — works, as evidenced by Georgetown’s Four Seasons Hotel, which opened in September 1979 and was the first of its kind in the U.S. The Four Seasons at 2800 Pennsylvania Ave., NW, opened on a former Metrobus lot with property developed by William Louis-Dreyfus. Founded by Isadore Sharp, the Toronto-based hotel company also introduced concierge service to North America. With $112 million invested in the property, the high-service, celebrity-frequented Four Seasons has grown to fit 222 guest rooms, a fitness center, a spa, event spaces and retail spaces. In addition, the Four Seasons has given millions to cancer research in direct and in-kind donations over its 35 years in operation.

At the 35th anniversary party on Sept. 19, founder Isadore Sharp said, “Washington put the Four Seasons Hotel on the American map.” He thanked everyone and said, “The future looks great.”

Sharp would also tell you the business’ success is owed to adherence to the Golden Rule.

The New Piano Man in Georgetown

•

With Mr. Smith’s recent move to the waterfront, Georgetown Piano Bar has a grip on M Street. The bar, which formerly housed dance club Modern, opened Friday, Sept. 12. We had a chance to talk to owner and Renaissance man Bill Thoet before the bar opened.

Georgetowner: You work as a consultant for your day job. What was the appeal of owning a bar from that perspective?

Bill Thoet: I’ve traveled alone a lot as a consultant and I’m not the type to just sit in the hotel room, so I go out. There are a lot of different places to hit when you go out. If you want to go out and be lonely, you can just go out to a regular bar. If you want to go out and meet people, you go to a piano bar. People are engaged in the music, the player and with each other. I can walk in there and in a few minutes I’ll be talking to 20 people.

GT: Has music always been a draw for you?

BT: Music, especially singing, has been a big thing in my family. My great grandfather was a medical missionary in China and was named one of the best baritones in China. My parents sing, my sister sings and I sing. I was in musicals in high school and that sort of thing.

GT: If someone comes in here on a random night, will they hear you sing?

BT: Oh yeah, absolutely. Every night I’m here, I will sing a couple of songs. One of my favorite go-to artists is Frank Sinatra. Sometimes I’ll sing “Ol’ Man River” by Paul Robeson since I can really go deep.

GT: What are your favorite three piano songs?

BT: “Piano Man” by Billy Joel and “House of the Rising Son” by the Animals. “Sweet Caroline” is always a fun one too because it brings everyone in.

GT: Why pick Georgetown as the location for the bar?

BT: I always had Georgetown in mind. It’s hard to find a place where you get walk-in traffic and that’s great for something like this. A lot of visitors walk through Georgetown and that is something I wanted to bring to the bar from my personal experience. Tourists come from hotels and when they see the piano upstairs and come on down, they’ll be hooked.

GT: What was it like changing the space from Modern to the Georgetown Piano Bar?

BT: It has been a huge project. This used to be a 90s club, with a white bar with bottle service, a disco ball and kitschy booths. We had to redecorate to give it a new feel. We brought it down with wood tones and brought in the piano. Now we have this bright red piano, which I was initially surprised by. But I think it makes the piano the center of the room, which was the concept from the outset. We have a player piano too that plays on its own when you feed it an old song scroll. We’ll use that when pianists are sick (laughs).

GT: Are you coming at the bar with your consultant hat on?

BT: Yes, we are trying to get feedback and improve constantly. We may strike a deal with some local restaurants so that patrons can bring food in here since we don’t have a kitchen. We may also get dueling pianists going back and forth with one another. It’s a fun theme.

GT: What do you like to do outside of work?

BT: I became the Chairman of the Board for the National ALS Association in February 2014. The ice bucket challenge has been amazing. This kind of viral thing has never happened before for an organization like ours, and the challenge has brought in $110 million and counting. For the grand opening of Georgetown Piano Bar, we’re planning on shaking martinis in an ice bucket and donating all proceeds to the local chapter of the ALS Association.

District Gets an ‘A’ for Return On Solar System Investments

• September 10, 2014

If you had $25,000 to invest, which of these three options do you think would provide the highest return with the lowest risk—dividend-paying stocks, 30-year U.S. Treasury bonds, or solar panels?

If you said stocks, you’re in good company. That’s what people are talking about these days—blue-chip dividend-paying stocks that are currently yielding between 3 and 4 percent in a low-inflation environment. If you said bonds, which offer a similar yield, you have plenty of company as well in the crowd that is turned off by stock market volatility.

However, you’d have given up control of your money—to Wall Street, to government regulation, to the fortunes of the companies, the competence of management, trends in industry, the next recession, geopolitical events and so on. You could make out like a bandit, but you could also lose more on your principal than you’ll earn on dividends.

Finally, the IRS gets its cut, reducing that $1,000 (at 4 percent) in dividend income on $25,000 worth of stock market exposure to as little as $800.

Solar panels, on the other hand, will not become more valuable over time, and you couldn’t sell them off your roof to meet a financial emergency. But if your instinct was to choose solar panels anyway, congratulations! You understand a basic concept that I spend much of my time explaining to clients—the best investments are generally those over which you have the greatest control of risk, cash flow and taxes. In the case of solar panels, these days in the District, neither stocks nor bonds can come close.

The financial return on a $25,000 investment in solar-retrofitting a home in the District includes several layers of tax credits (not just deductions), reduced electric bills, income from selling excess power back to the grid, increase in home value and saleability. D.C. homeowners currently enjoy the best of urban and federal tax breaks, earning an “A” ranking from solarpowerrocks.com, a consumer-driven information web site.

Using the theoretical $25,000 system as a example, the site estimates that after tax breaks and other savings, the cost would fall to about $10,000 at the end of the first year, pay for itself within five years and increase the value of an average home by about $35,000—with no increase in assessment for property tax purposes.

There are two lessons here. First, in D.C. you can go green and enjoy a healthy rate of return. Second, doing so illustrates a basic tenet of investing—before you let yourself be seduced by those juicy dividends and appreciation potential of stocks, consider investing in something you control, whether it be solar-upgrading your home, whole life insurance, real estate, your business or profession.

Your financial life is like a bucket with holes in it that constantly leaks money—living expenses, taxes, inflation, etc. To keep the bucket full you can try to pour more in by chasing the latest fad on Wall Street. That’s the hard way. The easier way, and the way you have the most control, is to plug up some of the holes by investing in things like solar that make you money by saving it.

John E. Girouard, CFP, CHFC, CLU, CFS, is the author of “Take Back Your Money” and “The Ten Truths of Wealth Creation,” a registered principal of Cambridge Investment Research and an Investment Advisor Representative of Capital Investment Advisors, in Bethesda, Md.

Fannie Mae HQ for Sale

•

Fannie Mae is abandoning its iconic, colossal headquarters on Wisconsin Avenue NW and moving to a consolidated office downtown. The driving force behind the move, according to company sources, is the building’s crumbling office infrastructure. Noted architect Leon Chatelain Jr. designed the Colonial Revival building to house the Equitable Life Insurance Company’s headquarters.

Construction of the 228,000 square foot space was completed in 1956. Looking forward, the property will likely draw the interest of local commercial real estate firms, in addition to educational institutions and embassies. From a commercial real estate perspective, the property would be best utilized as a mixed-use condo development, with its glut of space and its close proximity to public transportation.

This would require the current building to be razed in lieu of new, modern architecture, which could draw complaints about construction, traffic, parking, and green space, among other concerns, from the community and neighboring Sidwell Friends School, American University and area embassies, who would likely want to maintain the building as is for aesthetic purposes.

An acquisition of the property would be a logical choice for nearby American University, which has been leasing office space in a wide range of District locations over the past few years.

Assessed at $81,000,000

Business Ins & Outs

•

IN: Rent the Runway Coming to M Street

Rent the Runway, the women’s designer dress, gown and accessories rental business, has moved into 3336 M St., NW, part of the Cady’s Alley design, home and fashion district, EastBanc and Jamestown announced Sept. 8, with an opening planned for November. Nearby stores include Calypso St. Barth, Intermix, Steven Alan and Bonobos along with home design brands, Calligaris and Donghia.

IN: Artist’s Proof

Leaving Cady’s Alley, where it first opened last year, Artist’s Proof — a contemporary art gallery that features emerging artists from here and around the world — moved to 1533 Wisconsin Ave., NW. (One of its exhibitors, Christian Develter provided the art for this newspaper’s front page.)

IN: Do’s Custom Tailor on Regency Row

Do’s Custom Tailor and Formal Wear has moved to 3409 M St., NW. The shop had been at Wisconsin and M and before that at Georgetown Court on Prospect Street for years.

IN: Chaia Fixing Up Grace Street Shop

Known at the farmers markets near the White House and at Dupont Circle, Chaia (“farm to taco”) owners and chefs Bettina Stern and Suzanne Simon are planning their first brick-and-mortar place at 3207 Grace St., NW., in the former G. Morris Steinbraker building. Look for a spring 2015 opening.

OUT: Modern; IN: Georgetown Piano Bar

The Georgetown Piano Bar plans to open its doors Sept. 12 and will be located at 3287 M St., NW, former home of the nightclub Modern. The team creating the bar is composed of piano player Hunter Lang, former Mr. Smith’s manager Gene McGrath, former Mr. Smith’s employee Morgan Williams and Bill Thoet, according to the Washington Business Journal

IN: Tari Moves Up Wisconsin Avenue

After selling the property, having a sale and packing up, boutique owner Sara Mokhtari quickly found a new place for her clothing consignment business at the old Dalton Pratt space at 1742 Wisconsin Ave., NW. — with new inventory as well.

Jamestown Properties Buys Vornado’s Half of Georgetown Park for $270 Million

• August 7, 2014

Jamestown Properties — which works often with local developer EastBanc — is set to buy half of the Georgetown Park retail and office space for $270 million, according to Real Estate Alert Newsletter. It reported that “Bidding was aggressive for the 307,000-square-foot Georgetown Park, which a partnership between Vornado Realty and Angelo, Gordon & Co. acquired via foreclosure in 2010. The team repositioned the property and filled vacant space. Atlanta-based Jamestown, acting via its open-end Jamestown Premier Property Fund, is expected to see a stingy initial annual yield of less than 5 percent.”

Jamestown is buying Vornardo’s part of the property. The D.C. purchase price appears to be a record. The property includes Canal House and a 668-space parking garage, the biggest in Georgetown.

Restaurant Week Summer 2014

• August 6, 2014

Beginning Monday, Aug. 11, more than 200 of D.C.’s finest restaurants will offer three-course lunch and dinner specials for seven days only. Each year, the Restaurant Association Metropolitan Washington holds this event to give local foodies the opportunity to experience the region’s best restaurants at affordable prices; prix-fixe lunch and dinner menus are priced at $20.14 and $35.14, respectively.

Georgetown hot spot Cafe Milano will be participating in this week-long celebration, featuring a three-course lunch of some of its most popular dishes. Other local restaurants participating include Tony and Joe’s Seafood Place, El Centro D.F., Filomena Ristorante and I-Thai, among others. For more information about Restaurant Week and participating restaurants, visit ramw.org/restaurantweek.