News & Politics

Election Preparedness in Georgetown and the Rest of D.C.

Arts & Society

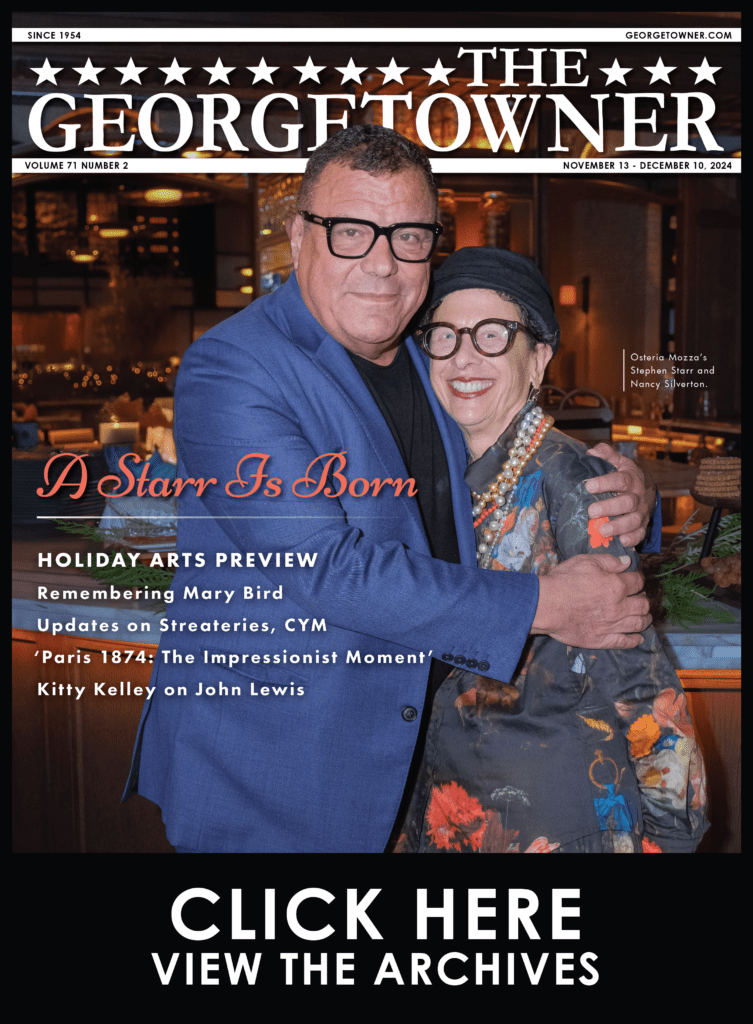

Osteria Mozza, Georgetown’s New Culinary Star

Featured

Business Ins & Outs: Osteria Mozza, Barnes & Noble, Framebridge

Featured

Business Ins & Outs: Billy Hicks, Marine Layer, Sweaty Betty

News & Politics

Catching Up With Ward 2 Council Member Brooke Pinto

Will Tax Cuts For Top Tier Create Jobs?

• July 26, 2011

My company is a small business. I think. We have approximately 25 employees. Even in our hometown Salisbury, North Carolina most people have never heard of us.

I’m not sure what the word “small” means, but compared to most companies in the US, we may be considered big. The IRS reports that approximately 6 million corporations, 3 million partnerships, and over 20 million proprietorships file tax returns. Corporations make the most money, have the best stats, and hire the most people.

Of the 6 million corporations, only 160,000, or 7%, have more assets than we have, and only 35,000, or 1.5%, have more sales than we do. Are we a small business? I certainly think so. Our employees think so. I wake up every day wondering if CVS or Walgreens or Walmart or all those other huge pharmacies are going to squash us.

So, I feel pretty much in the middle of this tax debate that is using small businesses as the bait for two hot tax issues. First, should taxes go up by 3% for people making over $250,000? Second, should employers have a payroll tax holiday if they hire new employees? Clearly, those tax breaks would increase my profits a little, but would they encourage me to invest and hire more employees? Absolutely not. Will it affect the 2012 election? Probably.

“Small businesses are the engine of job growth,” we’re told. Talking heads say that there are 700,000 small businesses earning over $250,000. On average, every county in the country has 200 small businesses earning that amount. In Virginia, Maryland, and DC, that’s reasonable, but drive 75 miles in any direction to an “average” county. Butch Cassidy was equally perplexed: “Who are those guys?” Most of those 700,000 small businesses earning over $250,000 are doctors and lawyers. Are they the engines for job growth?

Perhaps a brief tax history might help. In the early 1970s, Congress passed a 10% income tax surcharge to pay for the Vietnam War. Back then, both political parties were fiscally responsible, cooperative, and voted for that tax. It was pretty simple: compute your tax and add 10%. (Did you know that North Carolina has an add-on tax now?) If your tax bill was $1,000 and you had paid in $1,300, you would have gotten a $300 refund. But with 10% added to your tax bill, making it $1,100, your refund was only $200.

Over the next 20 years, taxes were cut on the idea that deficits would go down because economic growth would more than offset the revenue loss. Indeed, there was economic growth but deficits went up. President Reagan criticized President Carter’s $50 billion deficits, but his budgets (the President, not Congress, makes out the budget) were above $300 billion.

In 1988, the first President Bush, said, “Read my lips. No new taxes,” but knowing he had to be fiscally responsible, he raised taxes. In 1993, President Clinton raised tax rates at the top of the income scale about 3%. Over the next eight years, the economy grew like never before, tax receipts increased, and deficits disappeared. Microsoft, Apple, Coke, and many new and old companies grew like weeds despite higher taxes. The stock market tripled.

In 2001, the second President Bush passed a 10 year tax cut that is scheduled to expire at the end of this month. Today, compared to 10 years ago, the stock market is the same and unemployment is double.

Consequently, the United States now faces a huge and growing deficit problem. We spend $3 for every $2 we collect in taxes. There is waste, for sure, but not that much. Those dreaded “earmarks” are less than 1/10 of 1% of the entire budget. Contrary to popular belief, Congress cannot eliminate earmarks to balance the budget. In fact, just walking out of our wars and then eliminating the entire defense department completely wouldn’t balance the budget. Nor would eliminating Social Security completely. This is a really big problem.

Like students waiting until the last moment to prepare for exams, Congress has waited until the last moment to deal with the expiring tax cuts. (Frankly, this tax debate should be part of a larger debate about the entire budget.) President Obama is arguing that the Bush tax cuts should be kept for those making under $250,000. That will increase borrowing and the deficit by $2.7 trillion. The Republicans and some Democrats want to extend the tax cuts permanently which will increase borrowing and the deficit $3.7 trillion. So, this argument is about whether to borrow another $2.7 trillion or $3.7 trillion. Eliminating those pesky earmarks saves about $30 billion, or .001% of those amounts.

Why borrow these extra trillions? To help small businesses — like ours — hire people and grow. If my company earns an extra $10,000, these tax cuts save us $300. If Congress also passes a payroll tax holiday and we hire another employee for, say, $25,000, it will save us another $1,200. I’m not fond of taxes, but if the government cuts my company’s taxes $1,500, is that why my company is going to hire another employee? Not at all. We hire new employees when she or he is going to help our business, not to save $1,500 in tax.

Growing a business is about growing a business, not taxes. (Of course, we could move to the Bahamas or Ireland and reduce our taxes, but small businesses can’t do that.) No business decides to grow or not grow because of taxes. No business decides to hire a new employee or not because of taxes. Why doesn’t Congress understand that?

US Senator Everett Dirksen once said, “A billion here, a billion there, pretty soon it adds up to real money.” No more. Now, we talk trillions.

This debate is silly. Ignore the rhetoric. It’s about how much more are we going to borrow and increase the deficit. It is not about reducing the deficit by a dime.

David Post is the owner of a small business that was founded in Washington, DC and is on Inc. Magazines list of the fastest growing companies in the US. He was a professor at American University and Georgetown for 10 years. Contact him at: editorial@Georgetowner.com

Government Math

•

A one-mile high stack of dollar bills is about $1.4 million. A billion dollars would be about 70 miles high.

The first thing Congress did after the election was cut taxes by almost $900 billion. That stack of dollar bills would be 60,000 miles high – enough to go around the earth twice, and then go from Washington, DC to Moscow. And back.

That was my best Christmas present: lower taxes for two years. PLUS a cut in social security taxes, which will make my paycheck go up about $150 per month this year. (Of course, if I don’t get a raise at the end of this year, my paycheck will go down next January.)

Voters like tax cuts. And Congress loves to please the voters.

Voters are also screaming for budget cuts. Congress knows how to talk the talk. But it hates the walk because taking money away pleases very few voters.

Government math is hard to understand. Maybe big numbers are just hard to understand.

The new Congress is now wrestling with budget cuts. The Republicans’ “Pledge to America” promised $100 billion in spending cuts. But after a week of facing the realities of the budget, they have reduced their target to $50 billion with some whispers that even $35 billion is going to be hard to reach.

How much is $100 billion? A stack of dollar bills about 700 miles long – about the distance from Washington, DC to Chicago.

The federal government spends about $275 billion per month and brings in about $175 billion per month, leaving a monthly deficit of $100 billion per month. So $100 billion in spending cuts would be the equivalent of the federal deficit for one month.

These are huge numbers and the math is very difficult. It reminds me of a situation I was in about thirty years ago when a client of mine refinanced a $2 million loan. I took the $2 million check from the new lender to the bank and asked that it be deposited immediately so that we could write a check for $2 million to repay the old loan. The teller told me that we would have to wait three days.

I asked for an exception. The teller talked to a vice president and we were able to repay the old loan immediately. The teller apologized and said, “I don’t handle $2 billion deposits that often.”

“That’s $2 Million,” I said, “Not $2 Billion.”

The next thing I heard was the budget lesson of a lifetime: “Million, billion? What’s the difference?”

Maybe that teller was right. Is there a difference? Can we understand what this is all about? Maybe this is the new math.

Last month, Congress reduced revenues by almost $900 billion and this month, promised to cut spending by $100 billion, and now hopes to squeeze at least $35 billion out of budget expenses.

Think about it this way: The next time your income goes down $9, tell your family that that you are going to reduce the family expenses by $1. Then actually cut expenses by 35 cents. That’s the new congress. Declare the family victorious for being fiscally responsible. That’s the new math. That’s the new Congress.

David Post is the owner of a small business that was founded in Washington, DC and is on Inc. Magazines list of the fastest growing companies in the US. He was a professor at American University and Georgetown for 10 years. Contact him at: editorial@Georgetowner.com

Dog Days

•

Dr. Lee Morgan is, in many ways, the most satisfied of men.

“I can’t think of anything I’d rather be doing, anyone I’d rather be, except maybe an astronaut,” he says.

Morgan seems like a man who has found his niche, not like a safety net, but rather a place to be everything all at once: husband, father, family man, scientist, doctor, pioneer, responsible community person and a person who loves what he does.

“It’s not just my job, it’s my life,” he says of the Georgetown Veterinary Hospital, which he bought eight years ago and now runs. Love and empathy for animals, a key curiosity about advances in the veterinary field and interaction with person and pet alike coalesce there at 2916 M Street, the heart of Georgetown.

You might think when you first go into the greeting room at the clinic that Morgan is something of a celebrity doctor: there’s signed pictures of rocker Sheryl Crow, Karen Feld, who’s always brought her toy poodles and George Stevens Jr., the Georgetown resident who’s also producer of the Kennedy Center Honors.

“Not so much celebrity,” he says. “We just have a lot of good clients, the residents in Georgetown especially. Mr. Stevens is one of them, and they’re the kind of people that go that extra mile for their pets. They’re willing to do anything that’s needed.”

After a conversation with Morgan in the back room at the clinic, and taking into account his record, achievements and story line, you could get all sorts of impressions of the man: he’s gregarious, he loves to interact, and he’s high-energy. He’s well trained, smart, warm and a complete sucker for Buddy, the in-house part Rottweiler and Husky he and his family rescued. During the course of our hour-long talk, Buddy managed to cajole three treats out of Morgan.

“That means he wants to be petted,” he said as Buddy sidled up to me, nudging my hands with his head. Sure enough, Buddy struck a sit-down, heads-up pose perfect for petting, which he rewarded with a paw-shake.

“This is where it all happens,” Morgan said, showing me around. It’s a classic family operation — his wife Kris runs the office and his son Spencer works and helps out part of the time. There are a few other assistants and staff members, but on the whole, this is a perfect example of what folks mean when they say “small family business.”

Not too small, mind you: “We deal with about 100-200 issues a week, I’d say. Mostly, it’s the kind of things you find common to pets, to cats and dogs — diarrhea, eating disorders, vomiting, accidents, the things that you have to deal with pets on a regular basis. Dogs especially will get into anything.

“But I have to tell you, I get to do some pretty exciting things around here too, things you wouldn’t believe,” he says, telling how he was called by the Smithsonian to examine, with modern technology, a mummified pet. “That was very cool.”

When it comes to the science and advances in the field of animal health care, Morgan is right there, always keeping up. These days, he — and a number of others in the field — is quite excited about the use of stem cells to treat pets with degenerative diseases associated with age, such as arthritis and bone and cartilage degeneration.

“The idea is to inject stem cells, derived from fat from the dog, into the affected cartilage or joints. It can lead to repairing the damaged cartilage or bone,” he says. An early version of the treatment was used on a German shepherd who worked with his master, an American solider in Afghanistan. In an attack, his owner was killed and the dog suffered severe shrapnel wounds. The dog would not leave the soldier’s side but was brought to the United States, where he was a recipient of the stem cell treatment and improved remarkably. “That was an amazing thing,” Morgan says. We’ve had good results with this.”

He is the first doctor in the D.C. area to use stem cell treatment for dogs. “It has a great deal of potential for other pets. It’s not a guarantee because all cases and all dogs are different, but it’s been effective.”

It’s also an expensive treatment entailing a complicated three-day process that varies from dog to dog. “But now you have more hope for the issues that bigger dogs fall prey to, and that all of the dogs we love eventually have to deal with as they get older.”

Morgan didn’t start out wanting to be a vet — he started out as a marine biologist, which led to a stint at a dolphin training center in Mississippi where he met his wife, both of them working with dolphins up close and personal. “They are very, very special animals,” he says. “Everything you’ve heard about them is true.”

Eventually, he changed his major and decided on a career in the veterinary industry. “That was quite a while ago. It was a very different field than it is now — there was none of the technology that we have now, no MRIs, no advanced imaging or X-ray, all those very important things that let you know for sure what’s wrong. There wasn’t very much regulation of the industry when I started. That explosion in the pet industry, in interests in dogs and cats and the importance of the roles they played in people’s lives, that was just beginning. So it’s been fascinating to see all the changes. But I think dogs and cats have remained constant in their relations with us.

“I really believe in the power and importance of diagnosis,” he says. “So I believe in running tests. You should be sure about what’s wrong so that you apply the proper treatment. Blood tests, imaging, I believe in using and knowing about all the available tools.”

But Morgan has another important tool at hand: he has a deep curiosity about his patients and the people, and how they relate to each other, which makes him very much like a family doctor. That’s usually the sign of the very best veterinarians.

And he’s appreciated: in 2008 he was named Veterinarian of the Year by Veterinary Practice News, to go with the Washingtonian Magazine “Best Vets” Choice (2006), the IAMS Veterinarian of the Year Runner-up (2004), the American Veterinary Medical Association Practitioner/Researcher of the Year Award (2005) and the Best Veterinarian in American for the 2008 Northeast Region Thank Your Vet For a Healthy Pet Contest.

Not only that, he’s helped raise money for a mobile clinic serving injured police service dogs.

“We live in a major city, but we’re part of a community,” he says. “That’s one of the things in my role that I can help with.”

[gallery ids="99184,103271,103268" nav="thumbs"]

Ins and Outs

•

This week, Georgetown seems to be full of “ins” with no “outs.”

Pinkberry’s long-awaited Georgetown location at 3288 M St. opened partially Monday night, handing out free samples to frozen yogurt fans for one hour between 5 and 6 p.m. The event was a small taste of what’s to come in fall when Pinkberry will officially open shop.

Not far from Georgetown Ministry, Jack Wills university outfitters has signed its lease is prepping for a year-end opening near the intersection of Wisconsin Avenue and M Street (1079 Wisconsin Ave., N.W., next to Serendipity 3). The two-story shop will cater to a student clientele with a mix of “Britain’s rich history and culture, juxtaposed with a heavy dose of the hedonistic college lifestyle.” (Oh, great . . .) Jack Wills cannot be all bad-boy, though: It was the official apparel supplier to the Foundation Polo Challenge at Santa Barbara Polo Club, July 9 – you know, the one where Prince William’s team won as wife Kate looked on – which benefited the American Friends of the Foundation of Prince William & Prince Harry.

Another Jack, Jack Spade that is, could be in Georgetown by September at an undisclosed, according to Georgetown Patch. The chain, which is owned by Liz Claiborne, is mostly recognized for its bags designed for men, although the stores do carry clothing and accessories as well. Jack Spade grew out of its sister store, Kate Spade, a handbag store for women started by husband and wife Andy and Kate Spade. According to their website, the bags – both men’s and women’s – are inspired by a classic, practical look that is not short on style.

Finally, Good Stuff Eatery, Top Chef contestant Spike Mendelsohn’s not-so-average burger joint, is planning to open a third location in Georgetown according to an interview with Micheline Mendelsoh, sister and PR representative to Spike, in Washingtonian. Their first location on Capitol Hill will be followed by a second in Crystal City, with the Georgetown location opening after that somewhere on M Street.

Under One Roof

• July 25, 2011

Peter Hapstak and Olvia Demetriou sit caddy corner to each other at a long table in the main reception room of their Georgetown office. Their dark clothes set off naturally graying hair in that sleek way that people immersed in the world of art and design often possess, and their easy composure is slightly at odds with their surroundings, which are going through an obvious state of transition.

The pair are the leaders of their namesake architecture and design firm, Hapstak Demetriou +,

a group that is at once a fresh, energetic up-start and a team of seasoned professionals. Hapstak, a former principal and founder of CORE architecture + design, is relatively new to this office at 3742 Q St. NW, but to Demetriou the space is familiar – it was formerly the headquarters of Adamstein & Demetriou, the architecture firm she started with her former husband, Theo. Now the office building that saw the passing of one firm is seeing the birth of a brand new venture within its walls.

Although the stenciled sign on the door has yet to be changed, plenty of businesses and residents across the city – as well as across the nation – have taken notice of their presence and lined up to have their space transformed by Hapstak Demetriou +. The firm truly hit the ground running. Almost immediately, they drummed up several dozen projects which are now all in various stages of progress and completion, backlogging the small but growing crew into next year.

Between their packed roster of projects and the familiarity with which they talk about their firm, their projects, clients and each other, it would be easy to believe that the duo has been working together for years.

Yet less than six months ago, the two had considered themselves business rivals. In fact, they hadn’t even exchanged more than five words to each other in passing at cocktail parties over the last 20 years. Serendipity, however, seemed to have other plans for the two architects.

“In a way we both had partnerships but I think we each felt very alone and we were kind of at forks in the road. And a very good consultant that we both work with said that I really need to speak to Peter and Peter really needs to speak to me,” says Demetriou. “So we got together for coffee and then suddenly realized wow, it was really a convergence of both of us needing someone like the other. And it’s been a real process of discovery.”

Although they both describe their partings from past ventures as amicable, their excitement and enthusiasm about their work and the future of Hapstak Demetriou + is palpable.

“My journey was starting in December of last year and we really did not sit down until February or the beginning of March,” says Hapstak, describing the point at which he started to rethink his career future.

“It was exactly the same timing for me,” Demetriou says, talking over him.

“So neither of us really knew until that March period,” Hapstak continues.

“Mid-February was the coffee,” Demetriou cuts in.

“And then within two weeks it was done,” Hapstak says. “I can’t believe to tell you how right this shoe fits; I mean this is amazing to me. And I really love what we’re doing. I’m just pinching myself, I can’t…I think we’re both going to ultimately going to have the firm we really both wanted to have, which was this creative, think-tank, boutique firm that is flexible and agile, that can move very much.”

Hapstak Demetriou + is what the pair describes as a full-service design firm, guiding their clients through architectural and interior design projects from inception to opening. They take on a varied array of projects, but estimate that their undertakings are divided up between residences, miscellaneous projects, hotels and restaurants at 15, 20, 25 and 40 percent, respectively.

One project that is in the final months of completion is a 300-seat restaurant on Duke Street in Old Town, a collaboration with Kendle Bryan called Ginny’s (a sit-down full service restaurant) and Esquire Dog (a small café-style beignet shop by day and hot dog stand by night), which will be reminiscent of an old-fashioned drive-in. Hapstak describes the renovation of the old building as a portrayal of the resteraunteur, a former lawyer turned CIA trained chef, putting his life and personality into architectural form.

“I think we’re both chameleons with our work. Our design really does adapt to the client and the client’s identity instead of seeing, you know, our print on any project,” Demetriou says. “But we each do have a different style and in a way I think they’ll complement each other, those styles. I tend to be more structured and ordered, maybe formalist, minimalist.”

“I’m all about chaos,” Hapstak says.

“And Peter’s passionate and creative, and a lot of adaptive re-use and so that adds an interesting dimension to his work,” Demetriou continues. “So, you know, he’ll loosen me up and…”

“And she’ll tighten me up a little bit, which is good,” Hapstak cuts in.

Although Demetriou says that one person generally takes the lead as a client’s main contact for each project, their efforts so far have been largely collaborative.

“The beauty of a small firm is that one of us is always involved,” Demetriou says. “We don’t just assign things to our younger staff.”

This sense of collaboration is one of the driving visions behind Hapstak Demetriou +. The pair envisions the firm as an open-minded and creative force producing fresh and innovative ideas, and is working to balance their artistic ambitions with the realities of the market.

“Being a design-strong firm in a world where you’re dealing with corporate clients and businesses that have bottom line issues, money making issues, deadlines you know – you’ve always got one foot in the art world, like he [Hapstak] said, the think tank, and another foot in the business world,” Demetriou says. “And I do think that we want to stay on the more creative side of doing really good work, exciting work and working with interesting people and having a chance for reinvention with each project.”

As often happens in businesses of any size, the attitudes of the bosses trickle down through the rest of the employees, setting the work climate of the office. In this case, Hapstak and Demetriou’s enthusiasm is mirrored in the relatively young staff of architects and designers that they currently employ.

The youthful energy provided by the ambitious staff of 10 will hopefully propel the firm to new heights – Hapstak says that their young staff is not only helping them produce innovative ideas, but also helping them to fully take advantage of all the new technologies that can help grow the business.

But with two seasoned professionals at the helm, Hapstak Demetriou + will be less likely to fall into some of the blunders that other ambitious start-ups get caught in. The two pointed out common examples that green-behind-the-ears architects are likely to make, such as not giving strong enough guidance to clients and promising more than can be delivered. Between the two of them, Demetriou and Hapstak have designed more than 200 hospitality, cultural, private and public spaces in the nation’s capital, and have the contacts, resources and savoir-faire to prove it.

“I think the other thing that comes from us too is there’s a level of professional experience that you just can’t get with a younger firm,” Hapstak says. “I mean, our repertoire and our knowledge and all this institutional memory that we have, it kind of gets us to this point.”

Yet the two are far from jaded, and still take deep personal satisfaction in seeing their projects appreciated and used.

“Any time we walk into a project and see it full of people we know we’ve been successful,”

For this reason, both Demetriou and Hapstak take a special pleasure in public projects such as restaurants. They both enjoy the feedback they receive from visitors and the satisfying feeling of seeing customers and the owners of the venues enjoying and making use of their work.

Demetriou describes her passion for designing restaurants: “Restaurants are – they’re theatre. They’re our main square, our town piazza, it’s where we all go, you know – what are you going to do? Let’s go out to eat. This is what people do to socialize and to gather and connect. And I think even both separately, before the alliance and now, it’s very much part of how we work. You try to create a space that delights people, excites people, reinforces that message, sometimes subliminally, sometimes not so subliminally,” she says. “There’s always a message, like Founding Farmers has a message, Zaytinya has a message. Each restaurant has built into it through the materials, through the forms, through iconographic references that kind of make people think about that food, that concept, the chef.”

But although the two take pride in their work in D.C., Demetriou and Hapstak plan on extending their firm out to the national architectural scene.

“I think what’s big for us now is a national draw, we see ourselves moving out of this market,” Hapstak says. “As much as this will always be our home and this will always be a priority for us because this is where we learned and so our greatest level of give back is here. But we are now on other people’s radar screens, which is really great for us, which allows us to continue to grow the firm, continue to expand what we’re doing.”

Although they say the plans are too premature to discuss any details, they do say that they’ve investigated possibilities in Vegas, that they have plans in the works in Miami, South Beach and Coconut Grove, and that they’ve been pursued by clients in New Orleans in addition to a couple projects they’re working on in the northeast. One project which is well enough along to mention is a collaboration with chef Robert Wiedmaier for a new restaurant in Atlantic City.

It seems that the advent of Hapstak Demetriou + is the turning of a leaf in both architects’ lives.

“Olvia and I are very similar,” Hapstak says. “I was out of a marriage and out of a business, but I have to tell you something, there’s nothing I’ve learned more than that the relationships [I’ve built] have been there for me. And that makes me value them even more and makes me want to perform for them at an even higher level.” [gallery ids="100228,106495,106493" nav="thumbs"]

Today, the Debt Ceiling debate is MAD

• July 13, 2011

Fifty years ago, it was called MAD: Mutually Assured Destruction.

By the 1980s, the U.S. and the Soviet Union together had amassed 25,000 nuclear warheads aimed at each other. Carl Sagan, the people’s scientist, compared it to two people standing in a room the size of a football field filled up to their chins with gasoline, each holding 10,000 matches and each threatening to light one.

Today, the Debt Ceiling debate is MAD.

First, what is the Debt Ceiling? Until 1939, Congress approved the issuance of a Treasury bond every time the U.S. needed to borrow money to pay its bills. In 1939, Congress authorized the Treasury Department to borrow the money needed to fund the government, but set a limit on how much it could borrow. That limit is the Debt Ceiling. For the past several decades, the Treasury has been borrowing money four out of every five business days and the Debt Ceiling is approaching $14 trillion. Our lenders, in approximately equal amounts, are the Federal Reserve, U.S. investors and foreign investors (mostly the central banks of China, Japan and the United Kingdom).

Over the years, Congress has raised the Debt Ceiling with no fanfare. For example, the Debt Ceiling was raised during each year of George W. Bush’s Presidency, doubling from $5 to $10 trillion. Every time the Debt Ceiling was changed, a handful of Senators and Congressmen gave speeches on controlling the budget. Some voted against it, but they knew that others would vote to raise it.

This time, Congress is playing poker with the world economy as its chips. If the Debt Ceiling is not raised within a few weeks, the U.S. will not have enough money in the bank to pay its bills. That’s never happened, but we know it won’t be good and will probably have unforeseen consequences.

Greece defaulted, has riots in the streets, and is at the mercy of other countries. Lehman Brothers defaulted in 2008 when the government refused a bailout, and over the following months unemployment doubled and the stock market lost almost half its value. Lehman Brothers was a New York investment bank. Large, but not the largest. And nothing compared to the U.S. government.

For 2011, U.S. revenues are $2.2 trillion and expenses are $3.8 trillion. We borrow 40 percent of what we spend. How would Congress reduce spending by 40 percent next month? To listen to the talking heads, it sounds easy.

Some, including Presidential candidates, U.S. Senators and Congressmen, are saying that default would be avoided if we pay the interest and “prioritize” other spending with available funds, or cutting all other government spending by half.

Some suggest across the board spending cuts. If serious, beginning next month, Social Security benefits would drop 40 percent along with reimbursements to health care providers, all government salaries, including our military, and interest payments to our lenders. That’s drastic, but social security, health care, defense, and interest on the debt account for more than 80 percent of the budget.

Others say “Just go back to 2003 spending levels” when spending was $2.2 trillion. That may sound logical, but that’s the same 40 percent cut.

Imagine an angry and crazy couple. One picks up their child and holds it over a bridge railing and says, “If you don’t do what I demand, I’m going to drop the baby and it’s your fault.” The other says, “No, it’s your fault.”

No crazy couple should negotiate that way. And neither should the Congress.

If Congress wants to cut spending, it holds the purse strings. The President can’t spend a dime unless Congress both authorizes and appropriates the money. If it were serious, Congress could pass legislation reducing spending by 40 percent and only give the President that much to spend with specific instructions. Parents do that all the time to their kids.

Economists and corporate CEOs are begging Congress to not play this game. Rating agencies are saying that the U.S. credit rating would drop below junk bond status. It would be unmitigated disaster.

But this isn’t real poker. It’s pretend. Everyone knows that the United States is not going to default. Congress operates like kids doing their homework on a school bus a few minutes before an exam.

This debate is about demagogy. It is about political posturing, blaming the other party, and gaining political advantage up until the last minute. It is not about what is best for the United States or the world economy.

At least with nuclear warheads, everyone agreed it was MAD.

Ins and Outs

• July 12, 2011

Ins

Fleurir Hand Grown Chocolates at 3235 P St. NW is a recent in on the Georgetown dessert scene. Run by a husband and wife team, this chocolate boutique specializes in hand-made confections made from high-quality, natural ingredients. The brightly colored little chocolate squares are simplistic in design and range in flavors from the classic caramel or raspberry to the more novelty Lavender Shiraz or Pink Peppercorn.

Kraze Burger, a burger chain with roots in South Korea, has plans to open a Georgetown location, according to the Georgetown Patch. The joint offers healthy alternatives to traditional fast food fare including tofu, turkey and garden burgers. The chain, which has over 100 locations in Korea and neighboring countries, will enter the U.S. restaurant scene in Bethesda Sept. 1 before moving on to Tenleytown, Union Station and, of course, Georgetown.

According to the Georgetown BID, Calvin Klein Underwear will open its first store in the U.S. outside of SoHo this summer at 3207 M St. NW. With its high-fashion vibe and iconic advertisements, the new boutique will fit right in on the main M Street shopping strip.

Outs

After 27 years of business, Furin’s of Georgetown will close its doors at 2805 M St. NW July 31, another family-owned business put under by rising costs of operations and a slacking consumer market. The Georgetown Current reports that the building has been bought by Foxhall Partners, who also owns Hook and other Georgetown properties. Beloved for its warm customer service and delicious cupcakes, the bakery, café and catering service will be greatly missed in the community.

Lil Omm yoga studio will also leave its location at 4830 V St. NW in the Palisades July 31 after its lease runs out. The Georgetown Patch reports, however, that this does not mean the end for the family yoga/prenatal/childcare facility – the business plans to take a month off then resume classes at a new studio in September at a location that is yet to be determined.

Up is steeper than down

• June 29, 2011

Why is the slope up a hill steeper than the slope down a hill? Seems like it should be the same, but it never is.

Everyone knows that it’s easier to ride a bicycle downhill than to ride it uphill, or to fall into a hole than to climb out.

The economy works the same way. If a $1,000 investment drops to $800, that’s a 20% decline. But for it to go back up to $1,000, that’s a 25% increase. You see, the climb back up is steeper than the drop down.

Remember the good old days when things seemed to be going great and the Fed would increase interest rates to slow the economy down? Or a big increase in jobs would send the stock market down because it was worried that too many buyers would cause inflation.

The economy seems to be counter-intuitive. Good is bad, and bad is good.

For example, the decline in housing prices has virtually crippled the economy, but it’s a good time to buy.

Banks are in trouble. With zillions of dollars of bad loans on their books and with housing values – their primary collateral – continuing to fall, banks are scared to make loans. Murphy’s Law says, “If anything can go wrong, it will.” Murphy’s Law of Banking stings even more: “If you qualify for a loan, you don’t need it.”

For years, economists complained that Americans “didn’t save enough.” We spent all of our money. That was a bad, but it made the economy grow, so it was a good. Credit card debt soared which was bad, but the stuff we bought made the economy grow, so that was good.

Today, we’re nervous about what tomorrow’s economy is going to do or look like, so we are changing our behavior. Now, Americans are saving more which is good, but by spending less the economy won’t grow, so that’s bad. We are paying down that mountain of credit card debt, which is good, but that money isn’t being used to buy the stuff that new jobs would make, so it’s bad.

The Japanese are very frugal people and famous for saving. That’s good, we were told. We should be more like them. But the Japanese economy has been in a funk for more than 25 years. Its stock market average was 10,000 in 1984 and after a blip, is still 10,000 while the US stock market is ten times higher than in was 25 years ago.

Do we really want to be like the Japanese?

The 2012 presidential campaign has begun, and until the election, the political rhetoric is going to be all about jobs. The political parties will blame each other, but more importantly, both will make promises they can’t keep.

During each decade from 1950 until 2000, the US created on average approximately 150,000 new jobs per month. From 2000 until 2007, US job growth was about half that, or 80,000 new jobs per month (despite huge tax cuts, but we won’t go there). Then, during the Great Recession of 2008 and 2009, the country lost 8.5 million jobs.

Do the math If we can start growing jobs at the rate we did from 1950 until 2000, that’s a 5 year climb to get back to 2007 employment levels. And that’s before a single new job is created. But what if the job growth rate from 2000 through 2007 is the new normal? In that case, climbing out of this ditch and getting back to even ground will take almost 9 years.

What about all this whining about the loss of manufacturing jobs? The US is already the most productive country on the earth. Most countries aren’t even close to American productivity. Each US worker produces 7 times more a Chinese worker and 13 times more than workers in India. As US workers become more productive every year, fewer people produce more. Increased productivity is good, right? But it means fewer jobs, so that’s bad.

It’s deeper than that. We don’t make shoes and shirts anymore. That stuff was easy. Today, we make satellites and electronic components, the hard stuff which requires more educated workers than it did to make shirts.

The presidential campaign will be fought with quick and easy sound bites. The problem is that these issues have no quick or easy answers. What politicians do know is that tearing things down is easier than building them back up.

Up is steeper than down. Go figure. How does anyone make an A in economics when the right answer might be wrong and the wrong answer might be right?

GBA Honors Long-Standing Georgetown Store, The Phoenix

• June 15, 2011

The Georgetown Business Association is honoring one of Georgetown’s oldest family owned and operated establishments, The Phoenix. The store opened in 1955 when Betty and Bill Hayes arrived home from a trip to Mexico, laden down with unique and vibrant folk sculptures, art, jewelry and clothing. They compiled their treasures and thus The Phoenix was born. Over the years the store evolved under the new ownership of Betty and Bill’s son and his wife, John and Sharon Hays. Along with their daughter, Samantha, the Hays have incorporated an international collection of popular women’s clothing designers, Mexican-inspired silver and gold jewelry and other artisan crafts collected from the family’s travels to Zambia, Thailand, Mexico and other various countries.

As a “founding father” of Georgetown BID and past board member of GBA, John Hays has always played a prominent role in the community. Hays may have even settled a longtime feud between the GBA and CAG, suggesting that instead of competing, the two associations should work harmoniously together in order to better the community and those who both work and live within Georgetown.

The Hays family has kept The Phoenix thriving and full of life over the past 55 years by always moving and growing and most importantly, absolutely loving what they do. With John in charge of buying the folk art and jewelry, his daughter Samantha as a buyer for the women’s clothing, and wife Sharon taking over the finances, The Phoenix is a well-oiled machine.

As for where the store may be in another 55 years down the road, “It’s up to the next generation,” Hays says. And with four grandchildren, two local to the area, there is certainly another generation standing by in the wings. But Hays isn’t pressuring, simply providing the opportunity. Whether they chose to convert the store into a McDonalds or keep it intact, Hays trusts that all will work out. John Hays’ secret to success? “Enjoy it!” [gallery ids="99980,99981,99982,99983,99984" nav="thumbs"]

Farewell Free Sightseeing

• June 2, 2011

As the cradle of U.S. politics, the whole of DC is biding its time and bracing itself for the imminent government shutdown. Although there’s still a chance to avoid the freeze, the odds are slim that Congress will be able to reach a consensus on the allocation of the 2011 federal budget before Friday’s midnight deadline. While it’s clear that a shutdown is looming around the corner, in these days of fractured parties it’s still uncertain how long it would last and how exactly it would affect the lives of DC residents.

Most noticeably, DC’s trash collection, street sweeping services, libraries and the DMV would close. Museums such as the different branches of the Smithsonian Institution along the Mall and the National Zoo would also shut down. Luckily, the animals in the zoo would continue to be cared for, fed and guarded during the shutdown, and private museums such as the Newseum would remain open.

It is currently unsure whether or not the National Cherry Blossom Festival would continue – festival organizers are trying to come up with a plan that will allow the events, such as Saturday’s parade, to take place as planned. Without federal funding, however, the festival must support its own cost of operations.

Because this shutdown is happening during tax season, it will have a larger impact on the IRS than shutdowns have in the past. The IRS will run on minimum staff for the duration of the suspension, meaning that tax returns filed online would be filled but those sent via snail-mail would remain unopened for an indefinite period of time. This does not mean, however, that you can file your taxes late without getting fined – they’re still due April 18.

Money and services from Medicare, Medicaid, Social Security and the Veteran’s Administration would be given out to those who were receiving assistance before the shutdown. Because of trimmed-back staff, however, new requests to these programs could go unanswered and become backlogged until the governmental hiatus is lifted. A backlog of federal loans could also occur. The Federal Housing Administration stated that federal home loan guarantees would be withheld and it is likely that requests for federals student loans would be postponed as well. Federal funding for unemployment programs could be stopped, leaving state governments to continue providing support for the unemployed on their own. Similarly, the shutdown could delay grants for research and police training.

The police forces that have already been trained would, however, continue to perform their duties as will jail systems and the court system although some cases, such as those concerning child support or bankruptcy, may be stalled. Agencies that protect homeland security such as the U.S. Coast Guard and security guards at airports would also continue their work, although many of their workers would have to go unpaid. Individuals trying to get new passports would also be affected, as they would have to wait until the shutdown ended to register for one.

Government websites that aren’t “essential” wouldn’t be updated, possibly because government workers in “unnecessary” positions would get an unexpected vacation as they wouldn’t have to go to work during the shutdown. They also, unfortunately, wouldn’t get paid for the duration of time that the hiatus lasts. After the 1995 shutdown these workers were reimbursed, but it’s still unclear whether or not that would happen at this time.

Some things, however, would remain the same. Public schools, for instance, would continue all of their services including providing lunches for students. NASA would continue to prepare for the April 29 launch of Endeavour, the military would continue to perform its duties unfazed and the U.S. Postal Service, true to form, would carry on delivering the mail.