News & Politics

Election Preparedness in Georgetown and the Rest of D.C.

Arts & Society

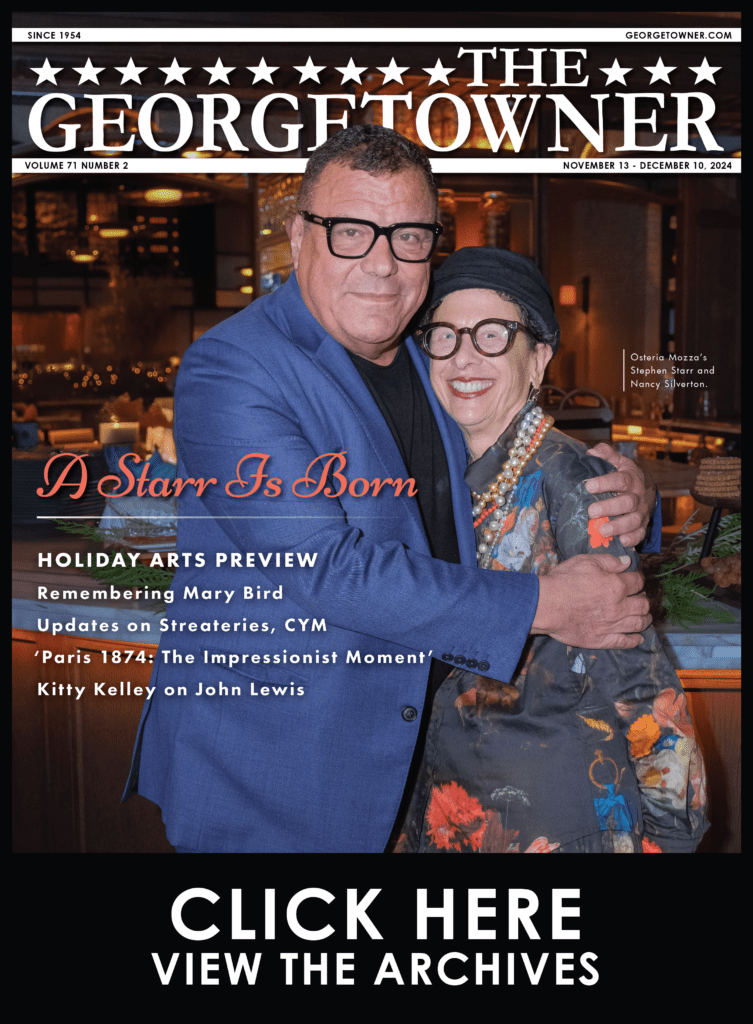

Osteria Mozza, Georgetown’s New Culinary Star

Featured

Business Ins & Outs: Osteria Mozza, Barnes & Noble, Framebridge

Featured

Business Ins & Outs: Billy Hicks, Marine Layer, Sweaty Betty

News & Politics

Catching Up With Ward 2 Council Member Brooke Pinto

BID Says Let Liquor License Moratorium Die

• October 28, 2015

The Georgetown Business Improvement District released a report recommending the moratorium on new liquor licenses be allowed to expire on Feb. 3, 2016, to “encourage new high-quality restaurants to open in Georgetown.” Begun in 1989 to address public drunkenness, late-night noise, litter and the like, the Georgetown moratorium is no longer needed, the BID contends, as such problems have “decreased dramatically.” If the moratorium is extended, “Georgetown will be the only neighborhood in D.C. to have restriction on all classes of restaurants,” exacerbating an “oligopoly of operators, economic rents and speculative behavior,” the group states.

COMING: Mashburn at G’town Court

• October 19, 2015

Mashburn, a clothing store out of Atlanta, will be coming in 2015 to 3206 N St., NW, which is part of the Georgetown Court complex and in the former space of Neyla Restaurant and a long-closed Chinese restaurant.

The store will stretch from Prospect to N Street with a women’s and men’s side. There will also be a coffee shop on the west side of the store, facing the courtyard. “Think L.L. Bean meets Starsbuck’s,” said the architect, who showed plans at the Dec. 1 meeting for the Georgetown-Burleith advisory neighborhood commission (ANC2E).

Britches of Georgetowne Founder Plans to Revive Brand

• October 15, 2015

For decades, it was the smart mark of the well-dressed man, a stylish retailer with a well-heeled attitude that could get both father and son wearing its clothing, Britches of Georgetowne—which added “Since 1967” on its labels from the very start. It is about to be revived almost 50 years later.

Britches of Georgetowne co-founder Rick Hindin, a businessman and entrepreneur, is known around Washington, D.C., for the iconic Georgetown clothing store as well as for Adworks, Chicken Out Rotisserie and Hinsilblon Laboratories—and the causal version of the men’s clothing store, Britches Great Outdoors.

“We can do this again,” said Hindin of the Britches revival. “It is a heritage brand, a legacy brand,” he said. “Manufacturers are seeking licenses for such brands. We have been working on this for a little over a year. The clothing will be targeted to millennials and baby boomers. There will be separate models for each segment with the same fabrication—ages 25 to 65 with the same taste level.”

Hindin bought the trademarks for Britches and with Stephen Wayne will revive the label and its apparel with sales expected to begin before the end of 2016.

Britches was sold by its founders Hindin and David Pensky in 1983 to the retail specialist, CML Group, although the two ran the business until the late 1980s. When they left, Britches, including Britches Great Outdoors, numbered 100 stores. The company formally declared bankrupty in 2002.

The first Britches was at 1245 Wisconsin Ave. NW—today, appropriately, the space occupied by Ralph Lauren. Its second store was at 1219 Connecticut Ave. NW, not far from Raleigh’s, Burberry’s and other men’s clothing stores, some still in business, others not, but all classic for their times.

Now a business consultant with his Asterisk Group, Hindin lives in Chevy Chase, Md., but he added that he was most proud of another thing he helped to found in Georgetown. In the early 1970s, Hinden along with John Laytham (Clyde’s), Richard McCooey (1789, the Tombs), Jim Weaver (Weaver’s Hardware) and Paul Cohn (J. Paul’s, Old Glory, Paulo’s) started the Georgetown Business Association.

While Hinden knows the power of ageless style and of nostalgia, he is also betting that baby boomer and millennial can agree on the branding power of Georgetown, D.C.

Biz Group Salutes Bank of Georgetown’s 10 Years

•

The Georgetown Business Association met for its monthly networking reception Sept. 16 at the rooftop of the Bank of Georgetown headquarters on 30th Street to help celebrate the hometown bank’s 10th birthday.

GBA president Sonya Bernhardt welcomed the rooftop crowd to congratulate the bank employees at their anniversary and especially Bank of Georgetown CEO, chairman and co-founder Mike Fitzgerald. Along with GBA members and guests, Bernhardt also wished past GBA president, Riyad Said, good luck in his new job and life in California.

Guests were treated to heavy hors d’oeuvres by Occasions Caterers as well as a beautiful sunset.

[gallery ids="102313,126455,126459" nav="thumbs"]

New Life for Former Cycle Life Space?

•

Cycle Life, the upscale bicycle shop and smoothie bar at 3255 K St. NW, has been closed since earlier this year, and the building is now for sale or lease. The property also houses Water Street Gym on the second floor, which remains open for business. Jamie Connelly, real estate principal for Summit Commercial, is conducting the sale. He tells us that numerous international buyers have surfaced due to the property’s Potomac waterfront views and parking (13 spots in total). The first floor retail-commercial space is 4,500 square feet with six parking spaces; the second is 6,500 square feet with seven parking spaces, subject to the existing lease with? Water Street Gym.

Connelly says that investors or developers may be looking to do a residential or hotel conversion due to the spectacular river views. He also believes that national and local retailers, high-end purveyors of food and wines and the diplomatic community could be interested. Connelly recently assisted the Oman government in securing a new 30,000-square-foot museum/cultural center space at 16th and L Streets. See him to check out a unique space in town.

When the Market Is Volatile, Drop Sails and Row

• September 23, 2015

In October 2007, the stock market reached a high. During the 18-month decline that followed, ending in April 2009, the market lost more than 56.78 percent of its value (as measured by the S&P 500 index). This resulted in a housing crisis and a crippling 10-percent unemployment rate, the lowest level since early 1997. Then, from the bottom in 2009, the stock market recovered, rising more than 215 percent by April 2015.

Investors, feeling they had missed out, began to reenter the market, only to be blindsided when volatility came back with a vengeance. From July 2015 to the middle of August, the market experienced an 11.16-percent decline. On Aug. 24, the Dow shifted more than 4,890 points. As of September, that number was over 10,000 points. So, yes, market volatility is here and probably here for a while.

What’s an investor to do to weather the storm? Perhaps now is the time to think of passive versus active investing. Proponents of index investing simply focus on fees, but I believe there are other factors to consider.

Think of it in terms of sailing versus rowing. If you are sailing and the seas are calm with the wind at your back, the fastest way to get to your destination is to roll out the jib. Sailing is index investing; I agree it works best in a rising market. But when the seas get rough and the wind shifts, any smart sailor will drop his or her sails and begin rowing so as not to blow too far off — hence, active management.

Historically, active managers have lagged behind benchmarks during long and strong bull markets, when security selection makes less of a difference. However, they tend to add value and make up that lost ground when markets level off or suffer corrections. (Again, it’s like sailing versus rowing.)

The S&P 500 is a market-capitalization index, which means the largest companies contribute a larger percentage of the return as well as the risk. As the markets increase, so does the risk. In 2014, five companies represented 11 percent of the index return, despite the fact that none of those companies was among the top 10 stocks.

During the tech boom of the 1990s, technology represented 34.5 percent of the S&P 500. It fell to the bottom in 2002, representing only 12.3 percent of the index. Financial stocks represented 22.3 percent of the index in 2006 and 8.9 percent at the bottom in March of 2009.

Investing in the S&P 500 at the peak of a market cycle is like speeding up going into an intersection rather than slowing down. Therefore, rather than abandoning a good strategy and jumping out of the market during volatile times, perhaps a little tweaking and moving from passive index investing to more actively managed investing could be the solution — keeping you on track and keeping your portfolio from blowing off course.

John E. Girouard, author of “Take Back Your Money” and “The Ten Truths of Wealth Creation,” is a registered principal of Cambridge Investment Research and an Investment Advisor Representative of Capital Investment Advisors in Bethesda, Maryland.

Georgetown’s Cat Café Boosts Prices, Changes Policies

• September 18, 2015

After instigating more than 23 cat adoptions, changes are coming to Crumbs and Whiskers, the cat café at 3211 O St. NW that opened two months ago.

First, the price of admission has been increased from $10 to $15. On the bright side, Crumbs and Whiskers will now offer customers complimentary coffee and tea, with the option to buy pastries, prepared off-site by Pâtisserie Poupon.

To reduce overcrowding, the café will now limit the amount of customers allowed inside from 37 to 24. New seating is also available inside.

Despite the changes, cat cafes remain popular. There is now a fundraising campaign to start one across the river in Alexandria, Va.

Boho Chic Free People Opens Aug. 21

• September 17, 2015

Free People, a Bohemian chic-inspired apparel and retail store that sells women’s clothing and accessories, will open its first store in D.C. – at 3009 M St., NW – on Friday, Aug. 21.

It is also throwing a grand opening party, 6 p.m. to 8 p.m., Aug. 21, with refreshments as well as free styling sessions in the new store, which sits between Sprinkles Cupcakes and Hu’s Shoes. The first 50 guests to arrive will get a free gift (we hear it will be a Free People tote bag).

Owned by Philadelphia-based Urban Outfitters, Free People has more than 81 boutiques in the U.S. and two in Canada. It has six stores in the Washington area. [gallery ids="102294,127655,127649,127667,127676,127660" nav="thumbs"]

Pepco Merger Rejected by District Commission

•

The D.C. Public Service Commission, a regulatory agency in charge of overseeing electric, natural gas and telephone companies, among others, rejected Exelon’s proposal to buy Pepco in a $6.6 billion bid on August 25.

After examining seven “public interest factors,” like the effect on ratepayers, competition in the market and the environment, the Commission concluded that, “taken as a whole, the transaction as proposed by Exelon and Pepco is not in the public interest.”

Mayor Muriel Bowser responded to the decision, saying, “I support the decision against the proposed merger. Moving forward, we want to ensure that DC utility ratepayers receive quality service, that we maintain and grow jobs in the District, and that we keep DC on our continued path toward sustainability.” The decision was also supported by POWER DC, a coalition formed against the merger.

Pepco and Exelon released a joint statement in response to the decision, saying, “We are disappointed with the Commission’s decision and believe it fails to recognize the benefits of the merger to the District of Columbia and its residents and businesses.” The release goes on to say that the two companies “continue to believe our proposal is in the public interest and provides direct immediate and long-term benefits to customers, enhances reliability and preserves our role as a community partner.” They said they “will review our options with respect to this decision” to figure out a path forward.

Psst!: Secret Service Is Hiring

•

Under the gun for security lapses, the Secret Service is hiring, big time. Over the next five years, the agency will add 700 officers to the uniformed division and 400 agents. At 17 percent, it is the largest increase in more than 10 years, as the agency tries to repair its reputation following numerous highly visible scandals.

After moving from the Treasury Department to the Department of Homeland Security, the agency’s annual funding fell from its previous pace, and hiring slowed. The 2016 budget, with a 16 percent increase — the largest since joining Homeland Security — appears to be a response to the notoriety.

According to a statement by Secret Service spokesman Brian Leary, “This hiring campaign is the result of attrition, anticipated growth and in response to recommendations set forth by the Protective Mission Panel in December 2014,” which occurred after a man entered the White House after jumping a fence.