Georgetown’s Residential Real Estate: The Year in RE-view

By • February 9, 2022 0 1283

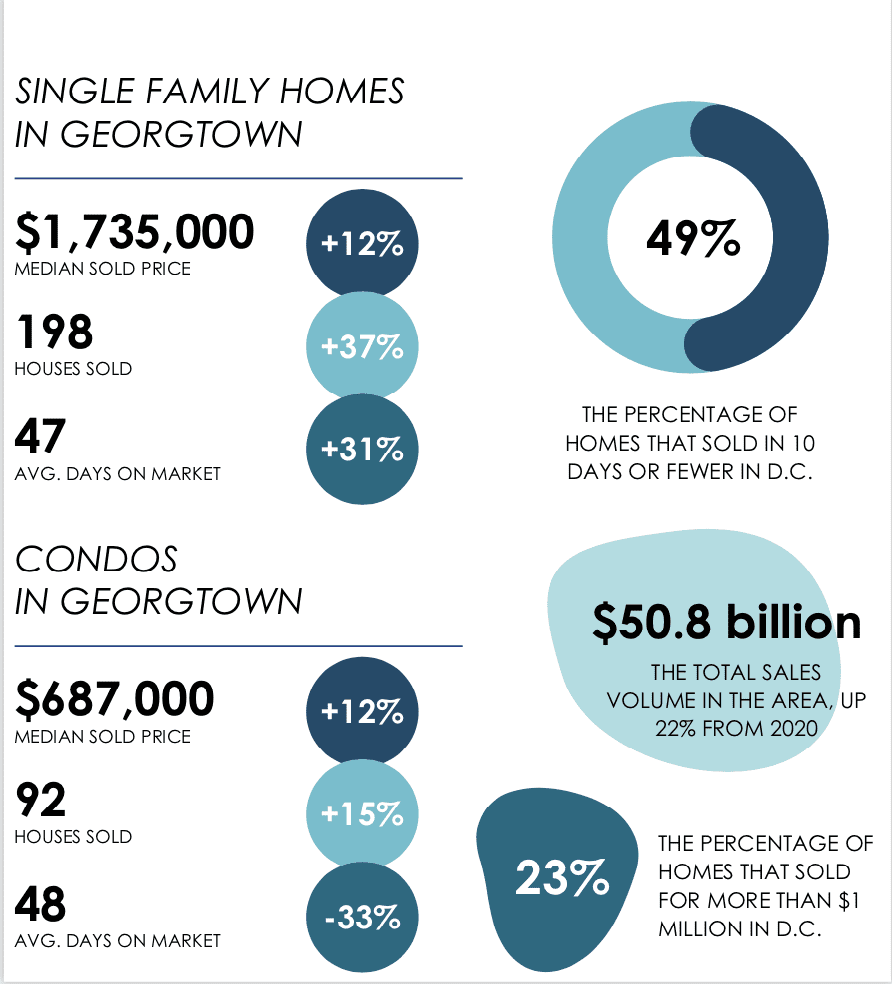

Last year’s Georgetown home and condo sales at a glance. Georgetowner infograph.

The basic rules of supply and demand drove the market to new heights

Covid? What Covid? Unlike so many people and sectors, residential real estate in 2021 proved virtually immune to the virus and its discontents — just as it did, surprisingly, in 2020. Low inventory combined with low mortgage rates continued to drive demand throughout the city.

According to a recent post in Urban Turf, the supply of homes for sale in D.C. is “dropping faster than anywhere in the Mid-Atlantic… with active listings down 38 percent compared to December 2020.” Good for sellers (and their agents). For buyers, not so much. Their road to home ownership was much harder and costlier.

Some other stats (per Bright MLS):

- 80,582 — The number of homes that sold in the D.C. region in 2021, up 13.5% from 2020

- $530,000 — The median home price in the D.C. region in 2021, the highest price on record

- $50.8 billion — The total sales volume in the area, up 22% from 2020

- 39,505 — The number of homes that sold for above asking in the region last year

- $48 million — The sales price for the most expensive home sold in the region last year

- 49% — The percentage of homes that sold in 10 days or fewer in D.C.

- 23% — The percentage of homes that sold for more than $1 million in D.C.

What can we expect in the coming months? The housing shortage is not going away anytime soon. Density-restricting zoning (especially in historic districts like ours) keeps housing stock low and for those “lucky” enough to afford a home, rising interest rates may cause them to think twice about this considered purchase. This is likely to push more buyers into the rental market with the inevitable pressure on pricing and availability. Supply chain and labor issues affecting the construction and home goods industries will continue to bedevil builders and, ultimately, buyers.

In other words, it’s still a seller’s market. And hold on to your wallets.